How How Do I Get A Copy Of Bankruptcy Discharge Papers can Save You Time, Stress, and Money.

Table of Contents4 Easy Facts About Chapter 13 Discharge Papers DescribedThe Main Principles Of Copy Of Bankruptcy Discharge What Does Chapter 13 Discharge Papers Mean?The Facts About How Do You Get A Copy Of Your Bankruptcy Discharge Papers Uncovered

Wedded people need to gather this information for their partner no matter whether they are submitting a joint request, different private petitions, or even if just one spouse is submitting (obtaining copy of bankruptcy discharge papers). In a situation where just one partner data, the income as well as expenses of the non-filing partner are called for so that the court, the trustee and creditors can evaluate the family's monetary placement.Hence, whether specific residential or commercial property is exempt and may be maintained by the borrower is frequently an inquiry of state regulation. The borrower needs to consult a lawyer to identify the exceptions available in the state where the debtor lives. Submitting an application under phase 7 "immediately stays" (quits) most collection actions against the borrower or the borrower's building (how to get copy of bankruptcy discharge papers).

Filing the application does not stay specific types of actions detailed under 11 U.S.C. 362(b), and also the keep may be efficient just for a brief time in some scenarios. As long as the keep is in impact, creditors normally may not start or continue legal actions, wage garnishments, or even telephone calls demanding payments.

trustee will certainly report to the court whether the instance must be assumed to be an abuse under the methods examination defined in 11 U. https://calendly.com/b4nkruptcydc/copy-of-bankruptcy-discharge-papers?month=2022-08.S.C. 704(b). It is very important for the borrower to coordinate with the trustee and also to provide any type of monetary records or files that the trustee demands. The Bankruptcy Code calls for the trustee to ask the borrower inquiries at the conference of lenders to make sure that the debtor is aware of the potential repercussions of looking for a discharge in insolvency such as the result on credit rating, the ability to file a petition under a various chapter, the impact of receiving a discharge, and the impact of declaring a financial debt.

The Main Principles Of Obtaining Copy Of Bankruptcy Discharge Papers

If all the debtor's possessions are exempt or subject to valid liens, the trustee will typically submit a "no asset" record with the court, and there will certainly be no distribution to unprotected creditors. The majority of chapter 7 cases entailing specific borrowers are no property instances.

A safeguarded financial institution does not need to submit a proof of claim in a chapter 7 case to preserve its safety passion or lien, there might be other reasons to submit an insurance claim. A lender in a chapter 7 case that has a lien on the borrower's residential or commercial property must seek advice from an attorney for guidance.

It contains all legal or fair interests of the debtor in residential or commercial property since the beginning of the situation, including building owned or held by an additional individual if the borrower has a rate of interest in the building. chapter 13 discharge papers. Generally speaking, the debtor's financial institutions are paid from nonexempt property of the estate.

The Best Strategy To Use For Obtaining Copy Of Bankruptcy Discharge Papers

The trustee achieves this by offering the debtor's residential property if it is cost-free and also free from liens (as long as the property is not excluded) or if it is worth greater than any kind of safety rate of interest or lien connected to the residential or commercial property and any type of exemption that the borrower holds in the residential or commercial property.

In enhancement, if the debtor is an organization, the bankruptcy court may authorize the trustee to run business for a limited amount of time, if such operation will profit creditors as well as enhance the liquidation of the estate. 11 U.S.C. 721. Area 726 of the Insolvency Code governs the distribution of the residential property of the estate.

The debtor is only paid if all various other classes of insurance claims have been paid completely. Accordingly, the debtor is not particularly thinking about the trustee's personality of the estate properties, other than with respect to the repayment of those financial obligations which for one reason or another are not dischargeable in the bankruptcy instance.

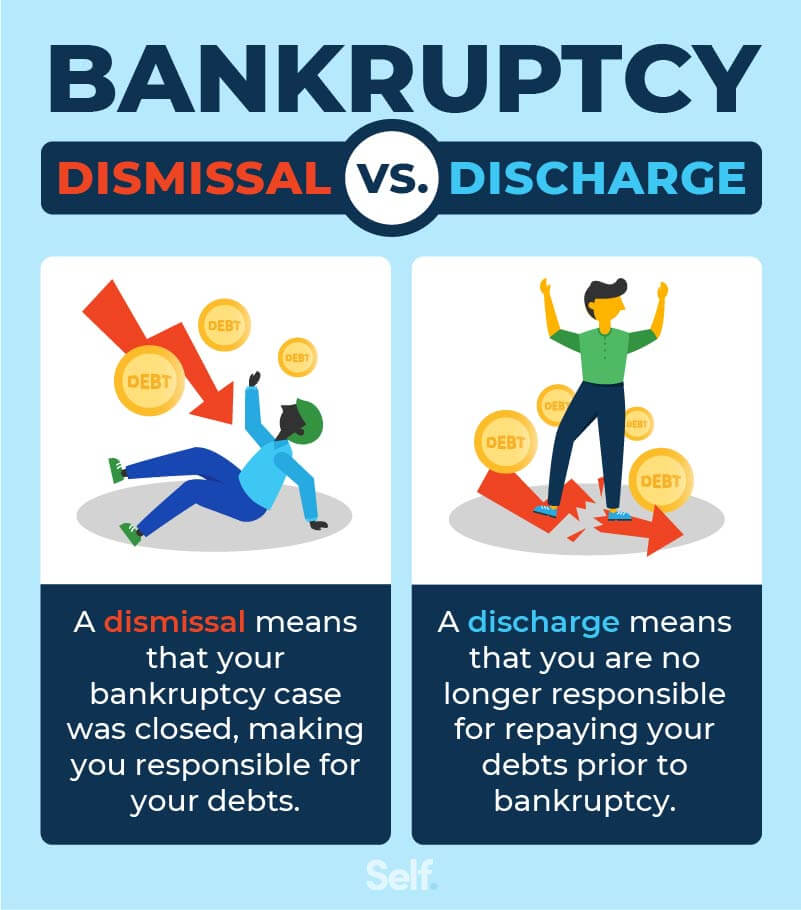

A discharge launches specific borrowers from individual liability for the majority of debts and prevents the creditors owed those financial debts from taking any collection actions versus the borrower. Because a phase 7 discharge is subject to lots of exemptions, debtors should seek advice from qualified lawful guidance before submitting to discuss the extent of the discharge.

The Buzz on Obtaining Copy Of Bankruptcy Discharge Papers

In return, the lender guarantees that it will not retrieve or reclaim the car or various other residential property as long as the borrower remains to pay the financial debt. If the debtor chooses to declare a debt, he or she need to do so prior to the discharge is gone into. The borrower must authorize a written reaffirmation arrangement as well as file it with the court (https://www.kiva.org/lender/saul35373280).

/bankruptcy-discharge-what-is-it-and-when-does-it-happen-8eafb0f711c24a048d4854a82cdb5f70.png)

524(c). The Bankruptcy Code requires that reaffirmation arrangements consist of a considerable collection of disclosures explained in 11 U.S.C. 524(k). To name a few points, the disclosures need to advise the borrower of the amount of the financial debt being reaffirmed and also just how it is determined which reaffirmation means that the debtor's personal obligation for that financial debt will not be released in the personal bankruptcy.

524(f). An individual gets a discharge for the majority of his/her financial debts in a chapter 7 personal bankruptcy case. A financial institution might no much longer launch or continue any legal or other activity against the debtor to collect a released financial debt. But not every one of an individual's debts are released in phase 7.